Merrick

Finance

Finance

Finance

4.6

Merrick Bank

free

Merrick Bank is a prominent financial institution in the United States, known for providing a wide range of financial products and services, including credit cards, personal loans, and certificate of deposit (CD) accounts. Established in 1997, Merrick Bank has grown significantly, serving over 3 million cardholders and managing billions in assets. The bank has built a reputation for offering accessible financial solutions, particularly catering to individuals looking to rebuild or improve their credit.

Since its inception, Merrick Bank has focused on meeting the needs of underserved consumers, particularly those who have faced challenges in obtaining credit. Over the years, the bank has expanded its offerings, adding more products and services designed to help customers achieve financial stability and growth. The development of Merrick’s product line has been driven by a commitment to providing fair and transparent financial products, with a strong emphasis on customer service.

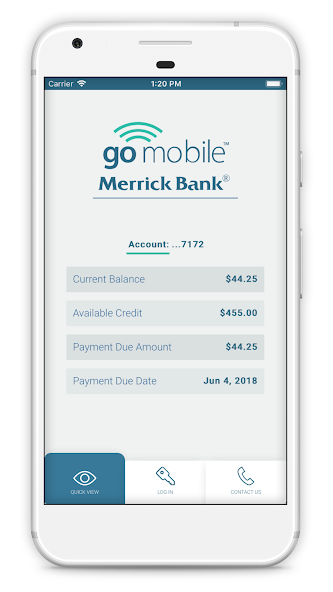

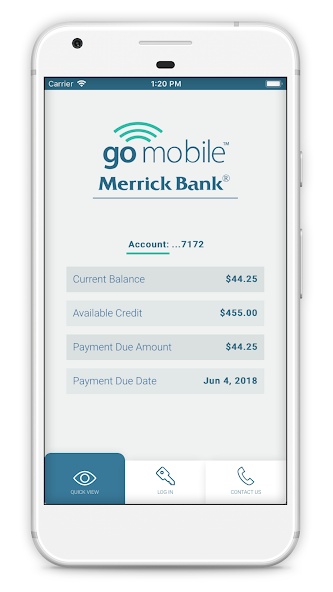

The bank has embraced technological advancements to enhance customer experience. This includes the development of a user-friendly online banking platform and a mobile app that allows customers to manage their accounts, make payments, and monitor their credit scores on the go. Merrick Bank’s focus on digital innovation ensures that it remains competitive in an increasingly digital financial landscape.

Merrick Bank offers several key financial products and services that cater to a wide range of customer needs:

Secured and Unsecured Credit Cards: Merrick Bank offers both secured and unsecured credit cards, making it accessible for individuals with varying credit histories. Their secured cards are designed to help customers build or rebuild their credit, while unsecured cards provide more flexibility for those with better credit scores.

Credit Line Increases: Merrick Bank is known for offering automatic credit line increases to customers who demonstrate responsible credit behavior, such as making on-time payments.

Flexible Loan Options: Merrick Bank provides personal loans with flexible terms and competitive interest rates. These loans can be used for various purposes, such as debt consolidation, home improvement, or emergency expenses.

Simple Application Process: The bank offers an easy and straightforward application process, with quick approval times and the option to apply online or over the phone.

High-Yield CDs: Merrick Bank offers certificates of deposit with competitive interest rates, allowing customers to grow their savings securely over time. The bank provides various term lengths, giving customers the flexibility to choose a CD that best fits their financial goals.

Free Credit Score: Merrick Bank offers its cardholders access to their credit scores for free. This feature allows customers to monitor their credit health and track improvements over time.

Alerts and Notifications: Customers can set up alerts to be notified of any significant changes to their credit report, helping them stay on top of their credit status.

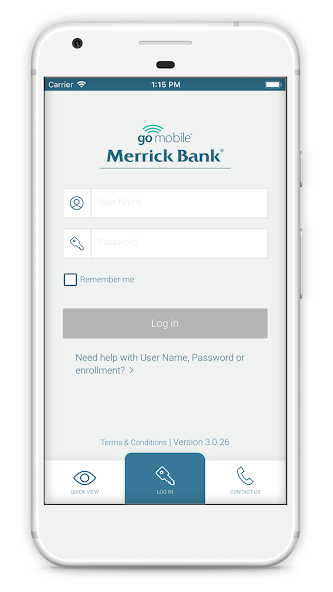

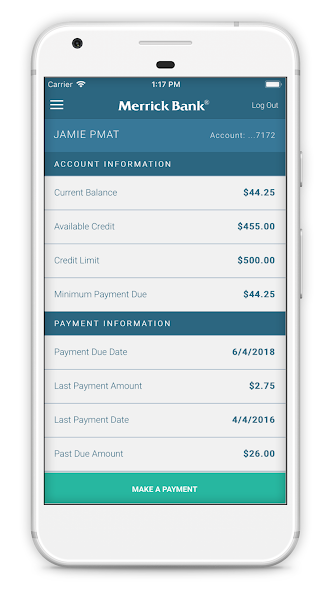

Account Management: Merrick Bank’s online banking platform and mobile app offer comprehensive account management tools. Customers can view account balances, make payments, transfer funds, and review transaction history from their computer or mobile device.

Secure Access: The bank’s digital platforms are equipped with robust security features, including multi-factor authentication and encryption, to protect customer information.

Merrick Bank operates with a strong focus on efficiency and customer satisfaction. The bank’s streamlined application processes for credit cards and loans make it easy for customers to obtain the financial products they need. Additionally, Merrick Bank’s online and mobile banking platforms are designed for ease of use, allowing customers to manage their accounts efficiently.

Merrick Bank’s customer service is another key operational strength. The bank provides dedicated support through multiple channels, including phone, email, and live chat, ensuring that customers can get assistance whenever they need it. Merrick Bank’s commitment to transparency is evident in its clear communication of terms and conditions, fees, and interest rates, helping customers make informed financial decisions.

Merrick Bank employs several promotional strategies to attract and retain customers:

Credit Building Opportunities: One of Merrick Bank’s key promotional points is its focus on helping customers build or rebuild their credit. The bank markets its secured and unsecured credit cards as tools for improving credit scores, appealing to consumers who need to repair their credit history.

Credit Line Increases: Merrick Bank often highlights its policy of offering automatic credit line increases to qualifying customers. This feature is promoted as a reward for responsible credit management, encouraging customers to use their cards wisely.

Competitive CD Rates: Merrick Bank frequently promotes its high-yield certificates of deposit, emphasizing the secure and reliable returns they offer. These promotions are aimed at savers looking for low-risk investment options.

Referral Programs: The bank occasionally runs referral programs where existing customers can earn bonuses for referring friends or family members who successfully apply for a Merrick Bank product. These programs help to expand the bank’s customer base while rewarding loyal customers.

Educational Resources: Merrick Bank provides financial education resources to help customers make better financial decisions. This includes information on credit management, saving strategies, and debt reduction, which is often highlighted in the bank’s promotional materials.

To get the most out of Merrick Bank’s products and services, customers can follow these tips:

Take advantage of Merrick Bank’s free credit score monitoring service. Regularly checking your credit score can help you track your progress and identify areas for improvement.

If you have a Merrick Bank secured credit card, use it responsibly to build your credit. Make small purchases that you can pay off in full each month to avoid interest charges and demonstrate good credit habits.

When investing in a Merrick Bank CD, choose a term length that aligns with your financial goals. Consider laddering your CDs by investing in multiple CDs with different maturity dates to balance liquidity and interest earnings.

Use Merrick Bank’s alert system to stay informed about your account activity. Setting up alerts for payment due dates, low balances, or large transactions can help you manage your finances more effectively.

To qualify for Merrick Bank’s automatic credit line increases, make sure to make your payments on time and keep your credit utilization low. This can help improve your credit score and increase your available credit over time.

Take advantage of the financial education materials offered by Merrick Bank. Learning more about credit management, budgeting, and saving can help you make more informed financial decisions.

If you have questions or need assistance with your account, don’t hesitate to contact Merrick Bank’s customer service. Their support team is available through various channels to help resolve any issues quickly.