Citigroup

Finance

Finance

Finance

11/12/2011

4.7

Citibank Singapore Ltd.

free

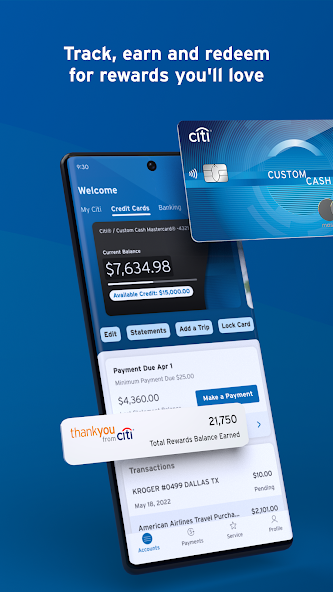

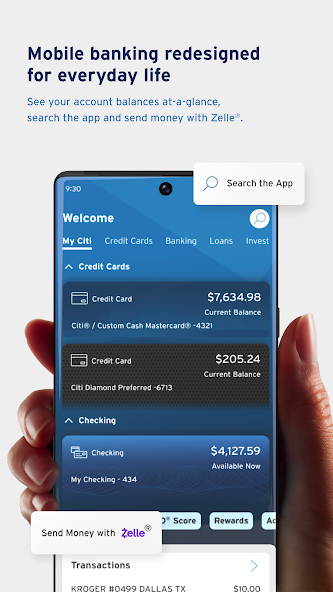

Citi Mobile, launched in 2010, is Citibank's comprehensive mobile banking application designed to bring the full suite of banking services to your fingertips. Over the years, Citi Mobile has evolved significantly, reflecting Citibank’s commitment to innovation and customer satisfaction. The app provides a convenient, secure, and efficient way to manage finances on the go, catering to the diverse needs of modern banking customers.

Since its release, Citi Mobile has undergone continuous updates to enhance its functionality and user experience. Initially offering basic banking services like checking balances and transferring funds, the app has expanded to include a wide range of features such as bill payments, investment tracking, and loan management. Citibank’s development team has consistently worked to optimize the app’s performance, ensuring it runs smoothly on a variety of devices.

User feedback has played a crucial role in the app’s evolution. Regular updates have introduced new features and improved security measures, reflecting the bank’s commitment to protecting customers’ financial data. The design of Citi Mobile has always focused on user experience, offering an intuitive interface and comprehensive help resources to ensure a seamless banking experience.

Citi Mobile offers a robust set of features to meet various banking needs:

Real-time account monitoring and detailed transaction histories allow users to stay on top of their finances and make informed decisions.

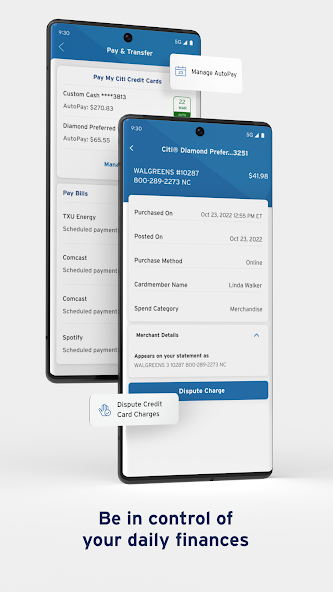

The app supports both internal transfers between Citibank accounts and external transfers to accounts at other financial institutions.

Users can pay utility bills, credit card bills, and more directly from the app, with options for scheduling and recurring payments.

Citi Mobile provides tools for managing investment portfolios, including real-time tracking and access to market insights from Citibank.

Users can apply for loans and track their status, ensuring they manage their financial commitments effectively.

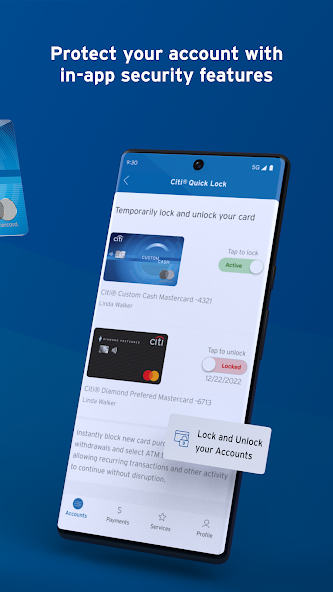

The app includes biometric authentication, two-factor authentication (2FA), and transaction alerts to ensure users’ accounts remain secure.

In-app chat and a comprehensive help center provide users with the support they need for any issues or inquiries.

Citi Mobile is designed for efficiency, with a clean, intuitive interface that allows users to complete tasks quickly and easily. The app integrates with digital wallets and supports push notifications to keep users informed of important account activities, enabling them to make timely financial decisions.

Citibank has implemented various promotional strategies to encourage the adoption and usage of Citi Mobile:

Welcome Bonuses: New users can receive welcome bonuses, such as cashback rewards or bonus points, upon registration.

Referral Programs: Users are rewarded for referring others to Citi Mobile, with both the referrer and the new user benefiting from the program.

Seasonal Promotions: Citibank offers promotions tied to holidays or special events, often including increased rewards for using the app.

Partnered Discounts: The bank partners with merchants to offer exclusive discounts to Citi Mobile users, providing additional value.

Educational Campaigns: Citibank invests in educating users about the app’s features through tutorials, webinars, and in-app guides.

To maximize the benefits of Citi Mobile, users should consider the following tips:

Keep the App Updated: Regular updates ensure access to the latest features and security enhancements, providing a smoother and more secure experience.

Use Biometric Login: Enable biometric authentication for quick and secure access to the app, reducing the risk of unauthorized access.

Set Up Notifications: Customize notification settings to stay informed about account activities, helping you manage your finances more effectively.

Explore Investment Tools: Take advantage of the app’s investment tracking and market insights to manage your portfolio on the go.

Utilize Customer Support: Use the in-app chat and help center for assistance with any issues, ensuring you get the most out of the app.

Maximize Rewards and Promotions: Keep an eye on Citibank’s promotions and take advantage of rewards like cashback and bonus points.

Secure Your Account: Use strong passwords, enable two-factor authentication, and monitor your account regularly for suspicious activity.