Zelle

Finance

Finance

Finance

12/9/2017

3.8

Early Warning Services, LLC

free

Zelle, a digital payment network based in the United States, was launched in 2017. It's owned by Early Warning Services, a private company jointly owned by several leading U.S. banks, including Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, U.S. Bank, and Wells Fargo. The conception of Zelle was a response to the growing demand for quick and convenient peer-to-peer (P2P) payment services. This demand was, at the time, largely met by independent platforms such as Venmo and Square's Cash App. Recognizing the market need, these major U.S. banks came together to offer a reliable, bank-backed alternative for instantaneous digital transactions.

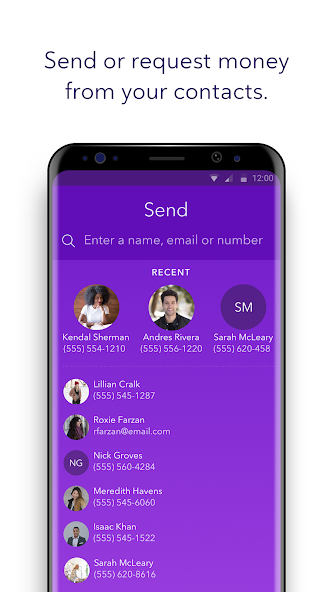

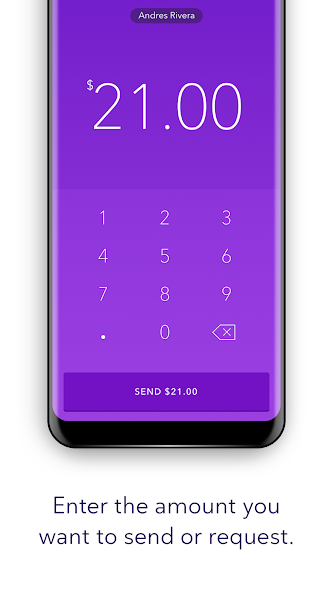

The application of Zelle is quite straightforward: it enables users to send, receive, and request money from friends and family, often without any additional fees. Its launch was pivotal, with the digital age driving the need for instant transactions. The ability to instantly pay a friend back for a movie ticket, split utilities with roommates, or even send a cash gift for a birthday, all from one's smartphone, provided significant value to users. Zelle, with its seamless integration with many major banks, gave users a convenient and trustworthy platform to handle such transactions.

However, as of my knowledge cutoff in September 2021, I'm unable to provide an accurate and current app rating. For the most recent and accurate ratings, I would suggest checking the Google Play Store or the Apple App Store directly.

One of the significant operational aspects that sets Zelle apart from many P2P platforms is its integration with the existing banking apps of several of its partner banks. This means that customers with these banks can use Zelle directly through their own bank's app, without needing to download an additional app. This built-in integration reduces the barriers to entry for new users, simplifying the user experience, and promoting wider adoption of the service.

Furthermore, Zelle transfers are typically quicker than those of many other P2P platforms. While other services might require a delay of one to two business days to move money from the app to a user's bank account, Zelle transactions, in most cases, occur within minutes. This immediacy of transaction processing provides a distinct advantage to users who require rapid transfers of funds.

From a promotional standpoint, Zelle has capitalized on its key features: convenience, speed, and safety. Being backed by many of the country's major banks gives Zelle a level of trust that independent P2P apps might not have. Users can trust that their transactions are secure, with the same level of protection provided by their regular banking institutions. Moreover, the speed and convenience of transactions, with instant transfers and easy access through existing banking apps, are also powerful selling points that Zelle often emphasizes in its promotional activities.

Users must understand that due to the speed of transactions, payments made through Zelle are typically irreversible. It's crucial, therefore, that users double-check transaction details before sending money.

Zelle is designed to facilitate transactions between friends, family, and others that users personally trust. It's not intended for transactions with unfamiliar individuals or unknown businesses. Unlike platforms such as PayPal, which have mechanisms in place for dispute resolution between buyers and sellers, Zelle does not offer the same level of protection for these types of transactions. As a result, Zelle advises against its use for transactions with people or businesses you are not familiar with. This is particularly important to keep in mind to avoid potential scams or fraudulent activities.

Another user tip involves maximizing Zelle's unique banking partnership. If a user's bank is partnered with Zelle, they can use the service directly through their bank's app. This eliminates the need for a separate app and helps to keep all banking and payment activities centralized and more manageable. In situations where the user's bank is not partnered with Zelle, the separate Zelle app can be used.

Finally, security measures should be treated as paramount when using Zelle. Since it deals with financial transactions, users should ensure they are taking appropriate measures to safeguard their accounts. This includes keeping login details secure, using strong, unique passwords, and taking advantage of any additional security features offered by the service, such as two-factor authentication. It's also a good idea to regularly monitor transaction histories for any irregular or suspicious activities.