Chase

Finance

Finance

Finance

10/10/2019

4.4

JPMorgan Chase

free

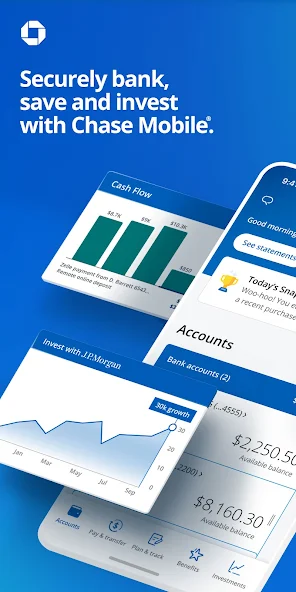

The Chase Mobile app, developed by JPMorgan Chase, is a comprehensive tool designed to offer its users a seamless and efficient banking experience. As technology increasingly becomes a central part of everyday life, Chase has embraced this trend by creating an app that allows customers to manage their finances directly from their smartphones or tablets. The app integrates a range of banking services, from basic account management to more complex financial transactions, making it a vital tool for Chase customers.

The Chase Mobile app is designed with user-friendliness in mind, catering to both tech-savvy and novice users. It encompasses several features:

Account Management: Users can view account balances, monitor transaction history, and access monthly statements for their checking, savings, and credit card accounts.

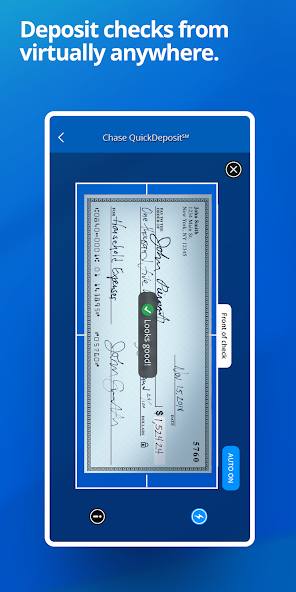

Mobile Check Deposit: This feature allows users to deposit checks by simply taking a photo of the check with their device, offering a convenient alternative to visiting a bank branch or ATM.

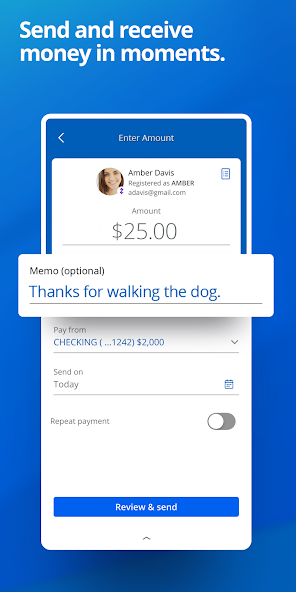

Bill Pay and Money Transfer: The app facilitates easy bill payments and the transfer of funds between Chase accounts. It also supports Zelle, enabling users to send and receive money with friends and family, regardless of where they bank.

Credit Card Services: Users can track their credit card spending, redeem rewards, and pay their credit card bills through the app.

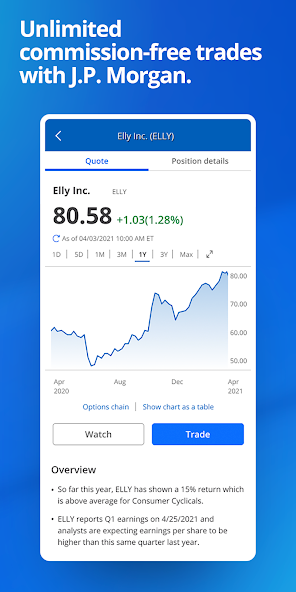

Investment Management: For those with investment accounts with Chase, the app offers tools to track investments and trade stocks.

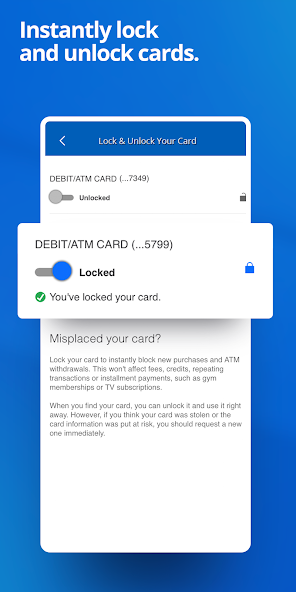

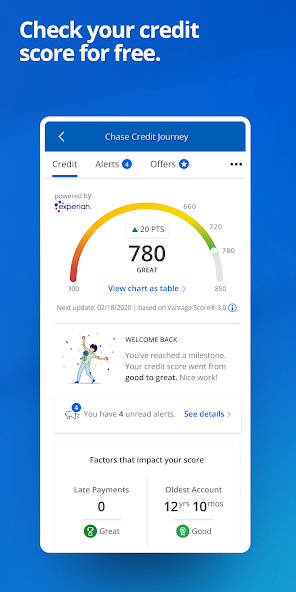

Security Features: The app provides robust security features, including fingerprint login, face recognition, and customizable alerts for account activity.

Chase actively promotes its mobile app through various channels:

Digital Advertising: Using online platforms to highlight the app's features.

Incentives: Offering special promotions or incentives for using certain features within the app.

Integration with Other Services: Promoting the app as part of a comprehensive banking solution when customers sign up for Chase bank accounts or services

To maximize the benefits of the Chase app, users should consider the following tips:

Familiarize with the App Features: Spend some time exploring all the features of the app to understand how it can best serve your banking needs.

Set Up Alerts: Customize alerts for account balances, transactions, and due dates for bills or credit card payments to keep track of your finances and avoid late fees.

Use Mobile Check Deposit: Take advantage of the mobile check deposit feature for quick and easy check deposits without having to visit a branch or ATM.

Monitor Credit Card Activity: Regularly check your credit card transactions through the app to manage spending and spot any unauthorized charges early.

Engage with Investment Tools: If you have investment accounts with Chase, use the app to monitor your portfolio and make trades on the go.

Stay Secure: Regularly update your app and use the security features like fingerprint or face recognition to protect your financial information.

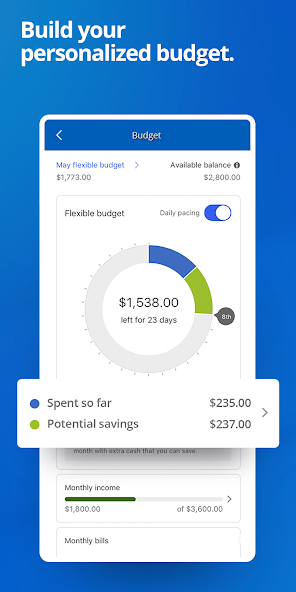

Explore Financial Planning Tools: Use the financial planning and budgeting tools within the app to gain insights into your spending habits and manage your finances effectively.

Keep the App Updated: Ensure that you are using the latest version of the app to benefit from new features and security updates.

Leverage Customer Support: Use the in-app customer support for any queries or issues you might face.

Participate in Promotions: Keep an eye on any app-specific promotions or incentives that Chase might offer for using certain features or for new users.