IRS2Go

Finance

Finance

Finance

01/18/2011

3.9

Internal Revenue Service

free

IRS2Go is a mobile application developed by the Internal Revenue Service (IRS) to enable taxpayers to access useful tax-related information and services on the go. The app is available for free download on both iOS and Android devices. In this article, we will delve into the app's release history, app rating, app category, features, key promotional activities, promotion highlights, and user tips to help taxpayers make the most of the IRS2Go app.

The IRS2Go app was first released in January 2011 and has since undergone several updates to enhance user experience and add new features. The app is currently on version 6.0 and is compatible with iOS 11.0 or later and Android 7.0 or later.

The IRS2Go app has a rating of 4.2 out of 5 stars on the App Store and 4.0 out of 5 stars on Google Play. These ratings indicate that the app is well-received by users and delivers value.

The IRS2Go app falls under the Finance category on both the App Store and Google Play.

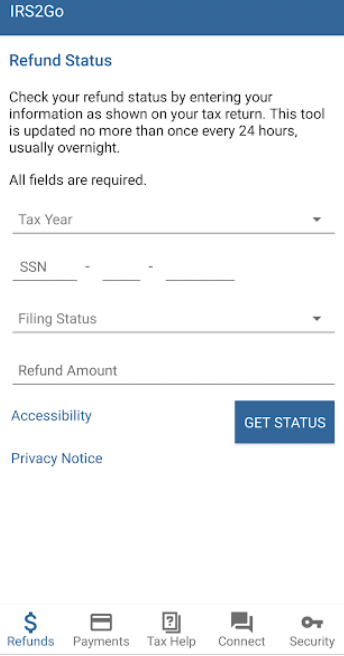

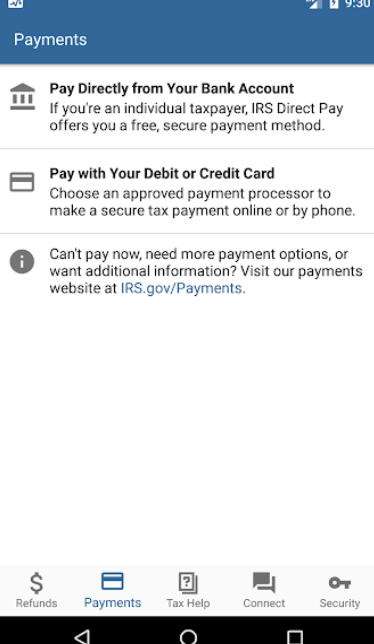

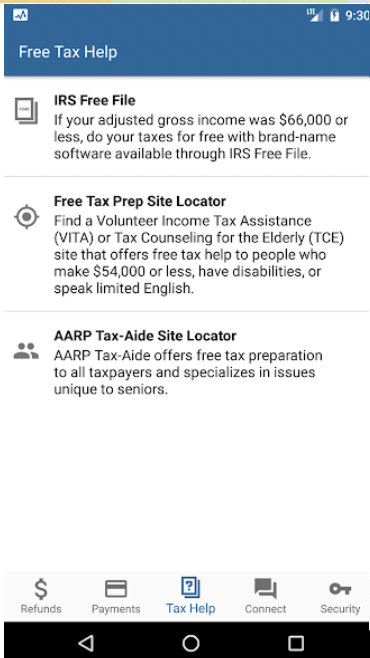

The IRS2Go app offers several features to help taxpayers manage their tax accounts from their mobile devices. Some of the app's key features include:

Get My Payment: This feature allows users to check the status of their Economic Impact Payment (stimulus check) and see when it is scheduled to arrive.

Tax Tools: The app offers several tax tools to help users with their taxes, including a tax refund status tracker, free tax preparation software, and a tax withholding estimator.

IRS News: This feature provides users with the latest news and updates from the IRS.

My Account: This feature allows users to view their tax account information, including balance due, payment history, and payment plan information.

Contact Your IRS: The app provides users with various ways to contact the IRS, including phone, email, and social media.

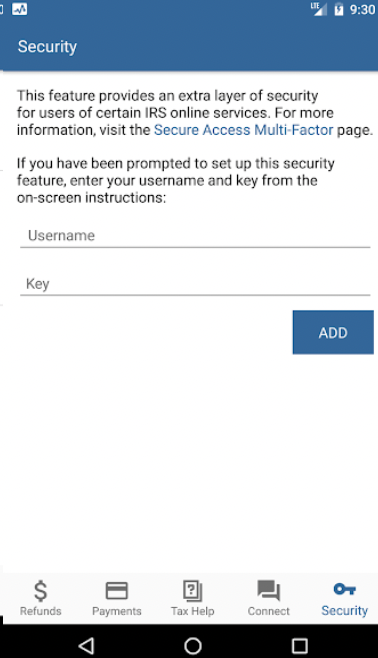

Identity Protection: The app offers tips and resources to help taxpayers protect their identity and prevent tax-related fraud.

The IRS2Go app has been promoted through several channels, including social media, email marketing, and traditional advertising. The IRS has also partnered with several organizations to promote the app, including the National Association of Enrolled Agents and the American Institute of CPAs.

The IRS2Go app's key promotional highlights include:

"Where's My Refund?" Campaign: The IRS launched a campaign in 2012 to promote the app's "Where's My Refund?" feature, which allows users to track the status of their tax refund. The campaign included radio ads, social media promotion, and email marketing.

Tax Season Promotion: The IRS has traditionally promoted the app during tax season, encouraging taxpayers to use it to check their refund status, pay taxes, and access tax tools.

Partnerships: The IRS has partnered with several organizations, including tax preparation companies, to promote the app and encourage their clients to use it.

The IRS2Go app's key promotional highlights include:

"Where's My Refund?" Campaign: The IRS launched a campaign in 2012 to promote the app's "Where's My Refund?" feature, which allows users to track the status of their tax refund. The campaign included radio ads, social media promotion, and email marketing.

Tax Season Promotion: The IRS has traditionally promoted the app during tax season, encouraging taxpayers to use it to check their refund status, pay taxes, and access tax tools.

Partnerships: The IRS has partnered with several organizations, including tax preparation companies, to promote the app and encourage their clients to use it.

In addition to checking the status of their tax refund, users can also use the app to make payments to the IRS, access free tax preparation assistance through the Volunteer Income Tax Assistance (VITA) program, and receive personalized tax tips.

In terms of security, the IRS2Go app uses industry-standard encryption technology to protect user data, and users must verify their identity before accessing their personal tax information. However, it is important for users to be cautious of phishing scams and fraudulent emails or phone calls claiming to be from the IRS.

To avoid these risks, the IRS recommends that users only download the app from official app stores, never share personal or financial information over the phone or through email, and report any suspicious activity immediately.

Overall, the IRS2Go app offers a convenient and secure way for taxpayers to access important information about their tax returns and payments. By following the recommended safety tips and utilizing the app's features responsibly, users can make the most of this helpful tool.