Capital One

Finance

Finance

Finance

29/07/2011

4.6

Capital One Services, LLC

free

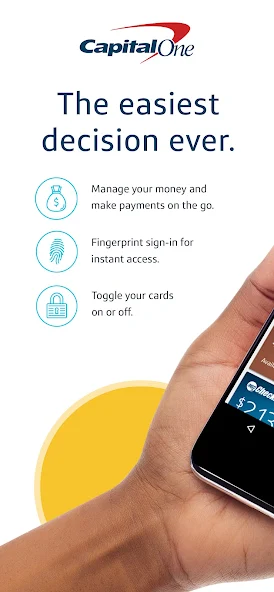

he Capital One Mobile App is an integral part of Capital One's digital banking services, designed to provide customers with a user-friendly, efficient, and secure mobile banking experience. As a prominent player in the financial services industry, Capital One has developed this app to meet the modern banking needs of its diverse customer base, offering a range of functionalities that enable users to manage their finances effectively through their smartphones or tablets.

The Capital One App is packed with features that cater to various banking and financial needs:

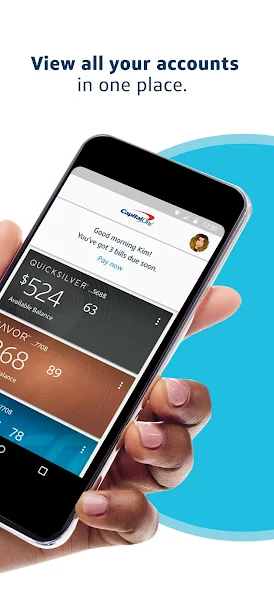

Account Management: Users can view balances, transaction history, and monthly statements for their checking, savings, and credit card accounts.

Mobile Check Deposit: This feature allows customers to deposit checks effortlessly by taking a photo with their mobile device.

Bill Pay and Money Transfer: The app enables users to pay bills and transfer funds between Capital One accounts, as well as to external accounts.

Zelle Integration: Incorporating Zelle allows for quick and secure money transfers to friends and family.

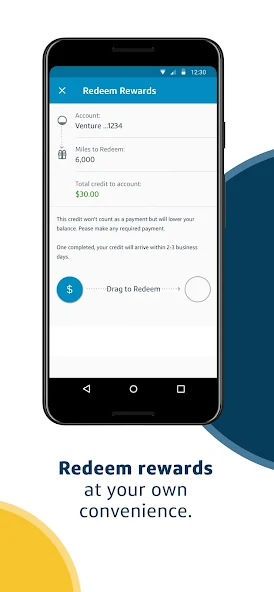

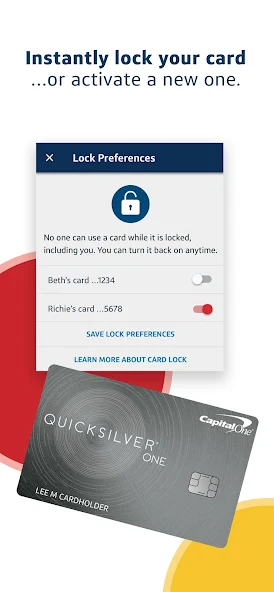

Credit Card Management: Users can manage their credit cards, track spending, view statements, and redeem rewards.

Investment Management: For those with investment accounts at Capital One, the app offers tools to monitor and manage investments.

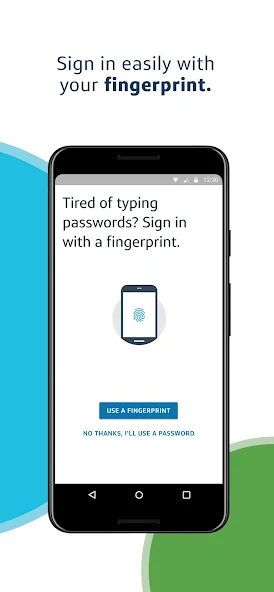

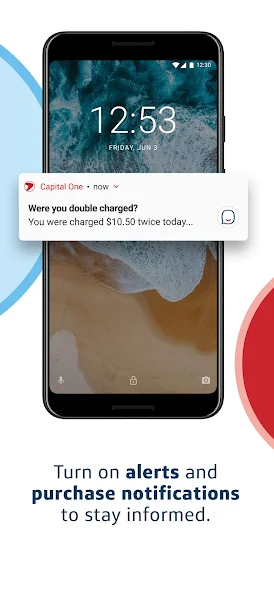

Security Features: Enhanced security measures include biometric login options and real-time alerts for account activities.

Capital One employs various strategies to promote its mobile app:

Digital and Social Media Marketing: Capital One actively markets the app's features and benefits across digital platforms, including social media.

Rewards and Incentives: Special incentives or bonuses are often offered for using specific features of the app or for new users.

Integration with Other Capital One Services: Promoting the app as an integral part of Capital One's banking services, offering a comprehensive digital banking experience.

To maximize the benefits of the Capital One app, users should consider these tips:

Explore the App's Features: Familiarize yourself with the app to understand how it can best serve your banking needs.

Customize Alerts and Notifications: Set up personalized alerts for account balances, suspicious activity, or upcoming bills.

Use Mobile Check Deposit: Make use of the convenient check deposit feature to save time.

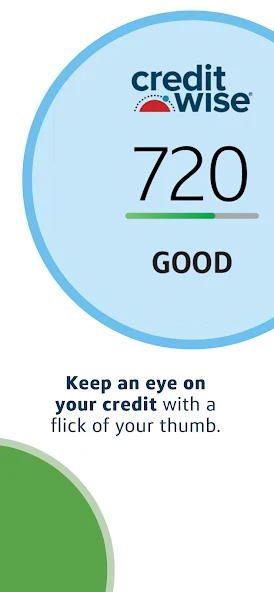

Monitor Credit Card Activities: Regularly check your credit card transactions through the app to manage your spending and detect any fraudulent activities.

Manage Investments: If you have investment accounts with Capital One, utilize the app to keep track of your portfolio.

Prioritize Security: Regularly update your app and use the biometric login features to enhance security.

Utilize Financial Planning Tools: Engage with any budgeting and financial planning tools provided in the app.

Stay Updated with the Latest Version: Regularly update the app to access new features and maintain optimal security.

Reach Out to Customer Support: Utilize the app's customer support for any queries or issues.

Participate in Promotions: Look out for and participate in any app-specific promotions or incentives that Capital One offers.