Afterpay - Buy Now. Pay Later

Shopping

Shopping

Shopping

05/08/2018

3.9

Afterpay

free

Founded in 2014 by Nick Molnar and Anthony Eisen, Afterpay is an Australian fintech company that offers a "buy now, pay later" service, allowing customers to purchase items and pay for them over four equal instalments due every two weeks.

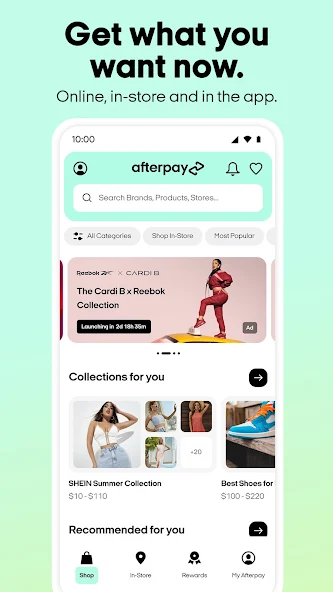

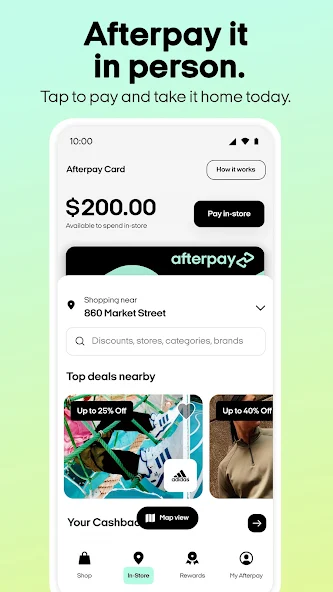

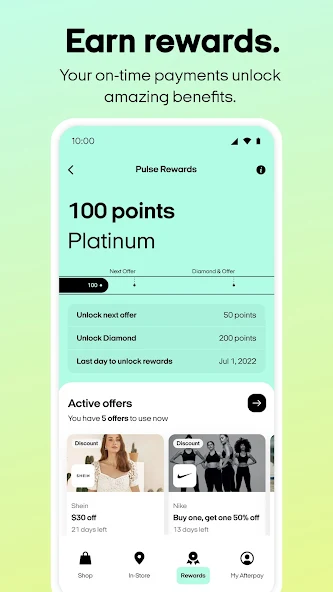

The Afterpay mobile app was introduced to further streamline the process and provide a platform where users can shop directly from partnered retail stores, view their installment plans and make payments. Afterpay's service effectively breaks down the total cost of an item into manageable installments, thereby reducing the immediate financial burden on the consumer.

Within a relatively short time, Afterpay has gained a substantial user base and has expanded its operations to the United States, the United Kingdom (under the brand name Clearpay), and New Zealand. By the end of June 2021, Afterpay had over 16 million active customers and more than 100,000 partnered retailers globally.

As of my knowledge cutoff in September 2021, I can't provide an accurate and current app rating. For the most recent and accurate ratings, I suggest checking the Google Play Store or the Apple App Store directly.

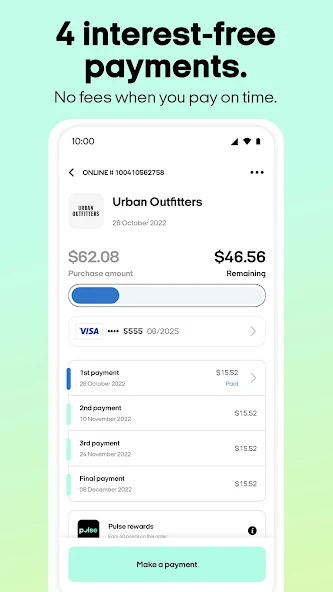

Operationally, Afterpay works by splitting the cost of a purchase into four equal payments spread over six weeks. Once customers create an Afterpay account and receive approval, they can start shopping with Afterpay's partner retailers. Afterpay pays the retailer upfront and the customer pays Afterpay back over time, with no interest charged if payments are made on time.

The promotion of Afterpay has been largely centered around the concept of "budgeting made easy." The company markets the ability to pay overtime without any interest as a major selling point. Additionally, Afterpay promotes its widespread acceptance in numerous online and physical stores to appeal to a wide range of shopping preferences.

Here are some tips for getting the most out of Afterpay:

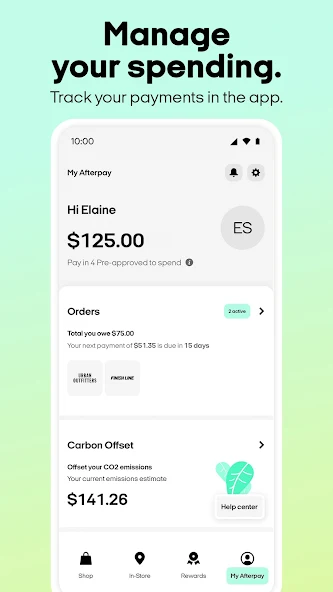

Keep track of your payments: Always ensure you have enough funds in your account on your payment due dates. Afterpay will automatically try to process the payments on the due dates, so maintaining sufficient funds is important to avoid insufficient fund fees.

Shop within your means: Although Afterpay allows you to buy now and pay later, it's still important to manage your spending and only purchase what you can afford to pay back.

Use the app to monitor your installment plans: The Afterpay app provides a user-friendly platform where you can view all your active and past installment plans. This can help you manage your finances effectively.

Afterpay has revolutionized retail shopping with its unique buy now, pay later service. By breaking down payments into smaller, manageable installments, it has provided consumers with greater flexibility and control over their spending. However, as with any financial service, it's important for users to use Afterpay responsibly and understand the terms and conditions thoroughly. For those who can effectively manage their spending and payment schedules, Afterpay offers a convenient and interest-free alternative to traditional payment methods.